With the macro backdrop remaining fairly fluid these days, it appears that market players are in search of the appropriate levels – for stocks, bonds, fed funds futures, gold, and just about anything else that might be impacted by a burgeoning crisis.

A week ago, traders were positioning for just that – a crisis in the banking system. There was an obvious and rather urgent flight to quality in most markets. This explains why megacap tech, with its “dependable earnings growth” and little need for financing became a favorite landing spot. As well as treasuries, cash, and gold.

Fast forward to the middle of this week and analysts now believe the Fed/Gov’t backstops put in place coupled with the quick sale of troubled banks provide a roadmap forward to prevent a widespread problem.

However, just because a couple of poorly run banks failed to blow up the banking system doesn’t mean there aren’t systemic issues lurking out there. For example, the big paper losses on treasury securities aren’t limited to regional banks. No, it’s the reported $29 billion in paper losses at Charles Schwab (SCHW) that have some investors concerned about some of the financial industry’s biggest players.

And our furry friends in the bear camp are quick to remind us that commercial real estate may be the next problem/shoe to drop. I’ll argue that the troubles in the CRE space aren’t exactly new and have been in place since COVID and the WFH movement. So, color me skeptical on that big bear call. But at the same time, this is something to keep an eye on going forward because the root causes of crises are rarely obvious.

So… With fears of a systemic bank crisis appearing to fade for now, traders have been quick to reverse those flight-to-quality trades. Well, kind of. The end result is a market that has moved up and down in the usual volatile fashion, with no real progress – in either direction.

As I mentioned above, I believe markets are looking for the right levels based on a rapidly changing narrative. Gone is the assumption that the Fed is going to wreck the economy by going too far. In its place are concerns about the state of the economy/risk of recession based on a potential credit crunch caused by banks tightening lending standards.

As such, it is little wonder that the stock market has gone largely sideways of late. While the reasons may have changed, the worries are still there. As in, will the economy/earnings be able to hold up as we work our way through the Fed’s inflation fight, the potential banking crisis, and a possible credit crunch?

This is why it is super easy for analysts of all shapes and sizes to continue to call for a recession. After all, it does appear that the odds are stacked against the bulls here and that the economy is bound to suffer for one reason or another.

Of course, those seeing the economic glass as at least half full argue that the Fed will surely mount up their white horses and ride to the rescue if need be. While Jay Powell and his merry band of central bankers can talk a good game about “staying the course” and “keeping rates high until the job is done,” the Fed has a very long history of (a) being terrible at predicting outcomes and (b) cutting rates in the face of a crisis and/or economic weakness.

Our heroes in horns contend that this time will be no different. Sure, Chair Powell has to keep talking a good game here. But if/when push comes to shove, rates are going to come down. Oh, and lest we forget, a banking crisis, a credit crunch, or anything else that leads to recession is hugely DIS-inflationary. Which HELPS the Fed’s cause on the inflation fighting front.

So, the question of the day appears to be, what’s it gonna be? The bulls are looking ahead to cheaper money, which, as history shows, tends to be good for growth – or – the next big crisis? For now, it appears the market is looking forward, but with a raised eyebrow.

P.S. On a personal note, I wound up rupturing my Achilles tendon playing pickle ball last week. My wife and I were getting our butts kicked by our daughter and her beau (both of whom played tennis in high school), so we decided we needed to be more aggressive and for me to “rush the net” (while staying out of “the kitchen” of course!) on every point. This approach did seem to improve our game, until I thought somebody hit me in the heel with a rock, I heard a “pop,” and wound up down on the court. I’m having surgery in the coming days and as such, I will likely take some time away from the blog.

Now let’s review the “state of the market” through the lens of our market models…

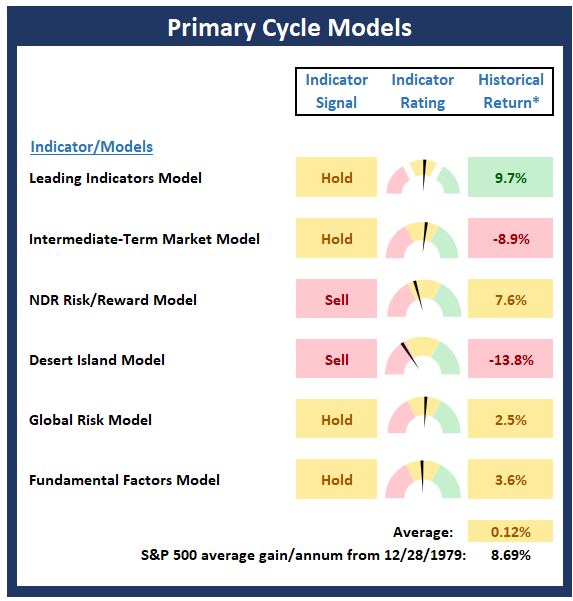

Below is a group of big-picture market models, each of which is designed to identify the primary trend of the overall “state of the stock market.”

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

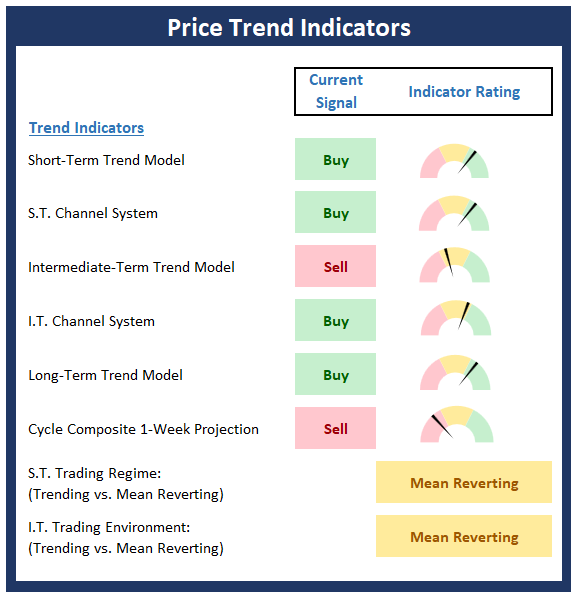

Below are the ratings of key price trend indicators. This board of indicators is designed to tell us about the overall technical health of the market’s trend.

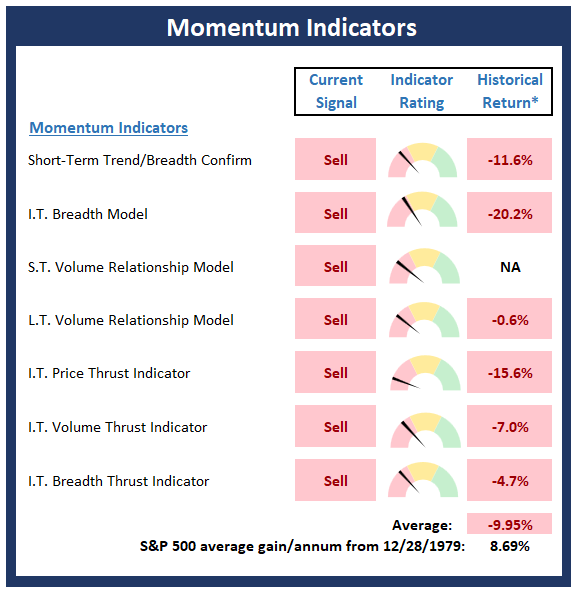

Below is a summary of key internal momentum indicators, which help determine if there is any “oomph” behind a move in the market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

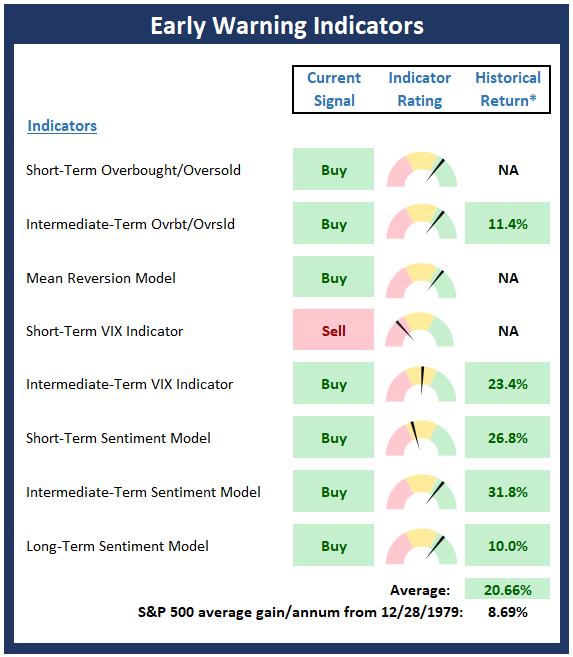

Below is a summary of key early warning indicators, which are designed to suggest when the market may be ripe for a reversal on a short-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

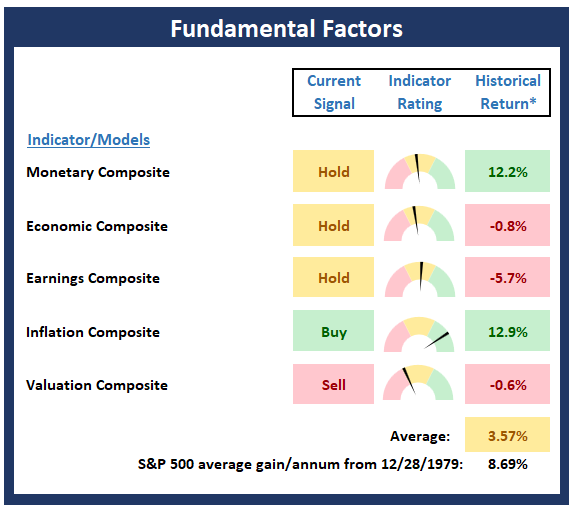

Below is a summary of key external factors that have been known to drive stock prices on a long-term basis.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

The simple problem of our age is how to act decisively in the absence of certainty. -Bertrand Russell

All the best,

David D. Moenning

Investment Strategist

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none- Note that positions may change at any time.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Redwood Wealth and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as investment recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning and Redwood Wealth may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.