As a reminder, we have made a change to the presentation of our market models and my oftentimes meandering morning market missives. The goal is to create a series of more concise, bite-sized reports, which will be published on a daily basis. Below is the weekly publishing schedule:

It is my sincere hope that you find the new schedule easier to consume and more beneficial to your investing endeavors.

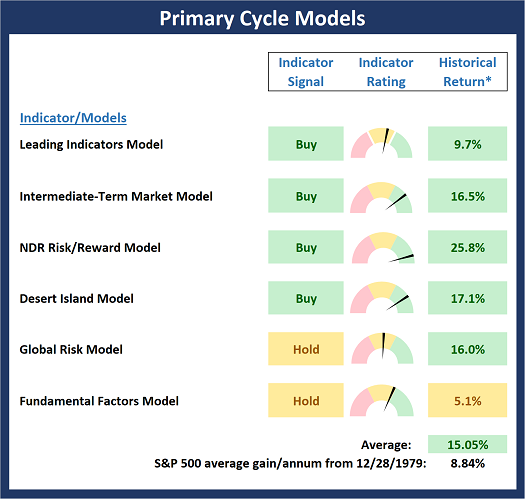

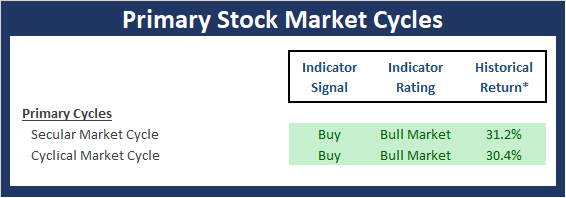

Although the market’s primary cycles do not change often, I still like to start each week with a clear understanding of what type of market we are dealing with. For me, a quick glance at the color of the cycle board and the weekly/monthly S&P graphs below tells me an awful lot about the “state” of the key market cycles.

My Current Take…

There is one change to report on the Primary Cycle board this week. After upticking to positive last week on the back of improvement in the economic composite, the Fundamental Factors Model slilpped back to neutral this week on the heels of the earnings composite falling into negative territory. However, as I’be been saying, I am currently taking the readings of the fundamental components with a grain of salt due to the fact that most of the models are long-term in nature and are not well suited for the current stop/start economic environment.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability – NOT INDIVIDUAL INVESTMENT ADVICE.

View the Primary Cycle Model Board Online

All in, I continue to view the big-picture market environment as moderately positive while recognizing that there are risks to be considered.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability – NOT INDIVIDUAL INVESTMENT ADVICE.

View the Primary Cycles Board Online

The Secular Market Cycle

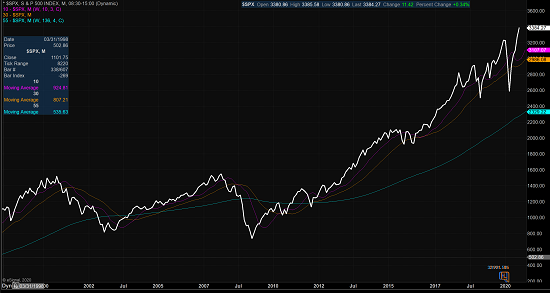

A secular bull market is defined as a period in which stock prices rise at an above-average rate for an extended period (think 5 years or longer) and suffer only relatively short intervening declines. A secular bear market is an extended period of flat or declining stock prices. Secular bull or bear markets typically consist of multiple cyclical bull and bear markets. Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 – Monthly

View Larger Chart

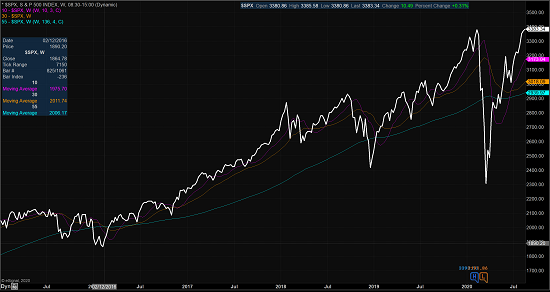

The Cyclical Market Cycle

A cyclical bull market requires a 30% rise in the DJIA after 50 calendar days or a 13% rise after 155 calendar days. Reversals of 30% in the Value Line Geometric Index since 1965 also qualify. A cyclical bear market requires a 30% drop in the DJIA after 50 calendar days or a 13% decline after 145 calendar days. Reversals of 30% in the Value Line Geometric Index also qualify. Below is a weekly chart of the S&P 500 illustrating the current cycle, which we estimate began on March 24, 2020.

S&P 500 – Weekly

View Larger Chart

Thought For The Day:

There is no hope for the satisfied man. -Frederick Bonfils

All the best,

David D. Moenning

Investment Strategist

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None – Note that positions may change at any time.

Primary Market Models Explained

Leading Indicators Model: A group of indicators that have historically shown tendencies to lead the market at major turning points.

Intermediate-Term Market Model: A composite model-of-models focused on trend and momentum indicators which has been designed to provide identify intermediate-term trading opportunities. The model includes 38 independent indicators covering price trends, volume, breadth, momentum, historical cycles, sentiment, and mean reversion.

Risk/Reward Model: A model-of-models designed to provide an overall view of the state of the risk/reward environment. The model includes tape, monetary, and sentiment indicators as well as 7 big-picture market model readings.

Desert Island Model: If I was stranded on a desert island with access to only one market model to manage money with, this would be the model. The model is a comprehensive model-of-models comprised of trend, momentum, mean reversion, economic, monetary, sentiment, and factor-based indicators/models.

Global Risk Model: A series of indicators designed to gauge the relative risk tolerance of the global investment environment.

Fundamental Factors Model: A model-of-models designed to provide a reading on the “macro state” of the environment. The model is comprised of indicators/models in the areas of monetary conditions, the economy, corporate earnings, inflation, and stock market valuation.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Redwood Wealth and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as investment recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning and Redwood Wealth may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.