Happy Monday and welcome to the final month of 2019, where the bulls will be hoping to avoid a repeat of last year’s epic December collapse and the bears are looking to capitalize on an overbought condition.

From a short-term perspective, it looks as if the much-anticipated pullback, correction, or pause is officially underway. The culprit for the current 240-point dance to the downside looks to be two-fold this morning. First there is the President’s apparent waffling on a trade deal. Trump said that while China still wants to make a deal on trade, “we’ll see what happens.”

Second, and likely more importantly, the most recent update on the economy came in on the punk side this morning. The Institute for Supply Management reported that the ISM Manufacturing PMI in the U.S. slipped to 48.1 in November. The report is problematic for a few reasons. First, the reading was well below consensus expectations of 49.4. Second, the reading was below last month’s 48.3. Third, recall that readings below the all-important 50-line indicate contraction in the manufacturing sector. Next, it is worth noting that New Orders component index slumped to 47.2 from 49.1. And finally, November’s PMI was the fourth consecutive reading below the 50-level.

Although everybody knows that it’s a struggle out there in manufacturing-land and that the American consumer is the real star of the show – being responsible for something like 70% to 80% of US GDP – the size of the PMI miss looks to have taken traders by surprise. As such, the “bad news” appears to have provided traders a catalyst to do some selling in a market that had become very overbought and sentiment was overly optimistic.

So, is this it? Has the top for the cyclical bull that began nearly a year ago on 12/26/18 been put in? Will we start discounting a full-blown recession from here?

Or… Is this simply a pullback within an established uptrend? A pause that refreshes, if you will.

The bears argue that with the manufacturing sector in a mild recession and many parts of the world also struggling mightily from an economic perspective, the rest of the U.S. economy will likely follow suit and begin to slide. Thus, our furry friends suggest that it won’t be long before we are all talking about the “R Word” again.

On the other sideline, the bulls are quick to point out that there are several reasons to remain hopeful. Our heroes in horns remind us it rarely pays to fight the Fed – or the rest of the central bankers that are currently in “easy money” mode. That the global slowdown could be bottoming out. That the earnings slowdown is temporary. That the American consumer is doing just fine, thank you. And that a trade deal, when it gets done, is likely to remove the negative overhang in terms of CEO sentiment and could easily release a fair amount of pent up economic activity. As such, those seeing the glass as at least half full contend that growth should re-accelerate once a deal is signed.

The bulls also remind us that stocks rarely move in a straight line to the upside. Well, except for periods such as January 2018, that is, and we all know how that turned out. No, usually, stocks tend to advance in a two/three-steps-forward and one-step-back fashion. Thus, pullbacks are part of the game and to be expected.

From my seat, the real tell will be how low the bears can get the market to go here. Given the shrinking number of days left on the calendar in 2019 and the idea that a great many managers are behind their benchmarks this year due to some ill-fated risk management efforts early in the year, one can argue that any/all dips are likely to be bought here. If this is to be the case, we should expect to see those dip buyers come in early and often when things get nasty.

If the bulls are to prevail here, I would expect to see the major indices remain in an uptrend and avoid any kind of oversold condition. I’d expect to see intraday buying come in today or tomorrow. And I’d expect to see the current leadership remain intact.

However, should the dark side prevail and sentiment towards the market/economic outlook becomes dour, one could argue that a test of the breakout zone around S&P 3030 could happen. And if that fails, then I’d expect to see the gap on the chart down at 2948.46 to be filled. Both moves would surely scare the bejeebers out of investors, especially if they were to occur before year-end.

And for those looking to further the recession argument, it is interesting to note that yields are actually rising this morning. This after a fairly big miss on the PMI. Typically, one would expect to see rates falling on weak economic data, not rising. Interesting.

Gun to the head, my thinking is we are seeing a type of pause or sloppy period in the stock market as traders mark time until the December 15 tariff deadline passes. If the White House insists on more tariffs, rest assured stocks will decline. And if China gets what it wants and tariffs are rolled back as part of the Phase One deal, then stocks will likely look ahead to better days.

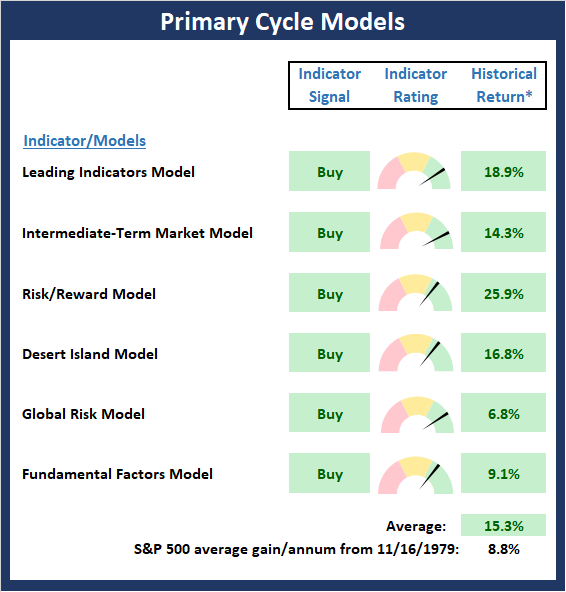

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay “in tune” with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the “state” of the overall market. Put another way, these models indicate which team is in control of the primary trend.

With all the negative talk about the state of global economies, it might be surprising to see the Global Risk model uptick into the positive zone. From my seat, the model’s move from yellow to green suggests that foreign markets are beginning to discount better days ahead. To be sure, we are seeing improvements in European markets as the now globally synchronized easy monetary policy works its way through the system. And while a pause in the action in the near-term wouldn’t be surprising, the Primary Cycle board tells us that the bulls remain in control here from a big-picture perspective.

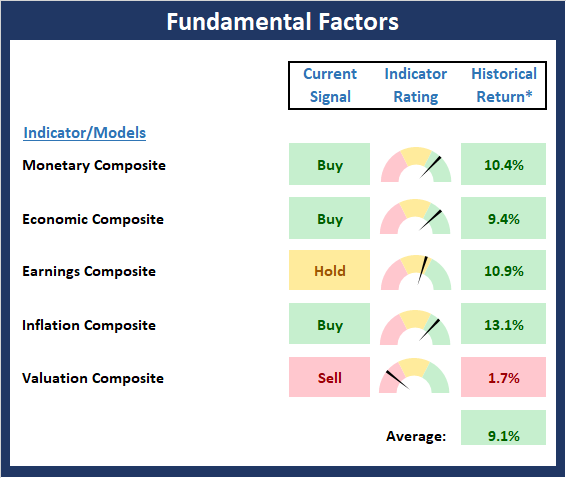

The State of the Fundamental Backdrop

Next, we review the market’s fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

There were no changes to Fundamental Factors board again this week. My takeaway continues to be that while valuations aren’t cheap and our earnings models are slouching a bit, the bulls can take solace in the fact that the global central banks remain friendly, inflation is low, and the economy appears to be growing – albeit at a less than robust pace. But, I’m of the mind that this combination is likely to give the bulls the edge as we head into 2020.

The State of the Trend

Next, we review the state of the current trend. This board of indicators is designed to tell us about the overall health of the current market trends.

There can be little argument that the trend appears to be a stock investor’s friend here. Yet, the message from the Early Warning board is also clear: A pullback, a correction, or at the very least, a pause in the uptrend is to be expected. As such, a test of the trend (and the bulls’ resolve) wouldn’t surprise anyone at this stage of the game. Yet, given the state of both the Primary Cycle and Fundamental boards reminds us that any pullback would likely present an opportunity.

The State of Internal Momentum

Next, we analyze the “oomph” behind the current trend via our group of market momentum indicators/models.

Last week, I noted that some weakness was starting to creep into several of the Momentum Board’s component indicators. This week, we should note that both the S.T. Trend & Breadth Confirm indicator and the I.T. Breadth Thrust indicator upticked into their respective positive zone, but by the skinniest of margins. As such, I will contend that momentum is not as strong as all the green on the board might suggest and that if if the bulls have eyes on further gains, they’d best find a way to get some oomph behind the move.

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to “go the other way.”

Although a couple indicators on the Early Warning board have flip-flopped, my takeaway from the board continues to be that the table is set for the bears from a short-term perspective. However, as is usually the case after a strong advance, the bears will need some sort of catalyst to get any meaningful downside activity started. And I continue to believe that any snag in the “Phase One” trade deal could easily do the trick. So, with the 12/15 deadline for additional tariffs quickly approaching, I wouldn’t be surprised to see traders start to lean a little cautious.

Learning is not child’s play; we cannot learn without pain. -Aristotle

All the best,

David D. Moenning

Investment Strategist

Disclosures

At the time of publication, Mr. Moenning and/or Redwood Wealth Management, LLC held long positions in the following securities mentioned: None

Note that positions may change at any time.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Redwood Wealth and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as investment recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning and Redwood Wealth may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.