Executive Summary:

After the rather ridiculous run higher in July and August, during which time we saw some truly ridiculous moves in names like Tesla (TSLA) and AAPL on the back of stock split announcements (which, of course, mean N-O-T-H-I-N-G), the bears finally managed to get up off the mat and get back into the game over the past three sessions. The S&P 500 has shed -7% so far during this countertrend move lower and the NASDAQ 100 has dropped an eye-opening -10.9%. While the downside action has been violent and without a clear catalyst, I can’t say the move is surprising or even unwarranted. In short, things had gotten a bit silly to the upside and some sort of consolidation/correction was necessary. So, instead of a one-way street higher, we now have a ballgame on our hands where the outcome is not predetermined. And while my crystal ball is in the shop (again!), my best guess is what we’re seeing now is akin to a “one step back” type move – you know after two GIANT steps forward.

The State of the Trend Indicators

After scoring a perfect 10.0 for a few weeks, some downside price action in the market – and the accompanying deterioration in Trend Models – was to be expected. Perhaps the most important change on the Trend board is seen in the “Trading Regime” models as both the short- and intermediate-term models now suggest the uptrend has ended and a period of consolidation is upon us. From a short-term perspective, this suggests a trading approach utilizing the high and low ends of the range as turning points until a breakout occurs.

View Trend Indicator Board Online

NOT INDIVIDUAL INVESTMENT ADVICE.

About The Trend Board Indicators: The models/indicators on the Trend Board are designed to determine the overall technical health of the current stock market trend in terms of the short- and intermediate-term time frames.

My Take on the State of the Charts…

The stock market continues to set records as the NASDAQ moved from an all-time high to the “correction” zone (defined by the media as a decline of 10% or more from the recent high) in, wait for it, three days. And while the S&P 500 isn’t quite there yet, a drop of nearly 7% in three days is enough to get anybody’s attention.

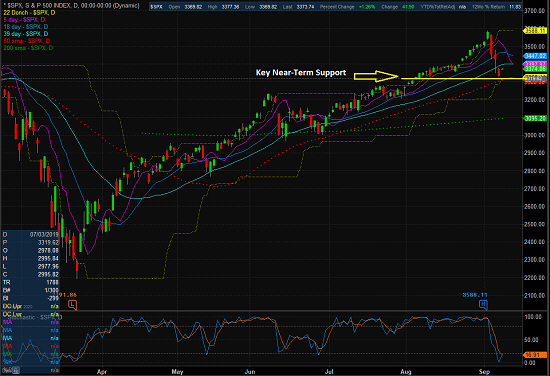

From my seat, the key question at this stage of the game is the pullback/correction/consolidation/pause will get worse. From a near-term perspective, you can say that the violent pullback in the highfliers has corrected some of the excesses seen as many stocks and the major indices have now “tested” important support zones. (see below)

S&P 500 – Daily

View Larger Chart

NASDAQ 100 – Daily

View Larger Chart Online

However, given the extreme overbought conditions and sentiment levels that were in place, I would not be surprised to see some additional “testing” take place in the coming days/weeks.

Of course, the bulls argue that since buying the dips in the leaders has been an exceptionally profitable strategy for a very long time, we should expect buying to come in to the leaders in short order. We shall see.

Since we had been comparing/contrasting the SPX/NASDAQ with the Russell 2000 for a few weeks now, I thought it would be a good idea to check in on the state of the market’s “troops” since the “generals” are pulling back.

iShares Russell 2000 ETF (IWM) – Daily

View Larger Chart Online

As you might expect, the damage during the current pullback has been less severe here (-5.4% in the IWM). This is due to the idea that there was less “froth” in the smaller companies that need real economic growth to produce gains in earnings.

For me, the bottom line here is that companies requiring real economic improvement (as in pre-COVID levels) continue to remain stuck in a sideways range, waiting on the economy.

Next, let’s check in on the state of the market’s internal momentum indicators.

View Momentum Indicator Board Online

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability – NOT INDIVIDUAL INVESTMENT ADVICE.

As you would expect during a swift correction, there are some changes to note on the Momentum board this week. Our Short-Term Trend and Breadth Confirm indicator and both the intermediate-term Volume and Breadth indicator have moved into the red. The good news is that while the shorter-term indicators are feeling the heat of the decline, the market’s longer-term momentum has not (yet?) been impacted to any great degree.

Thought For The Day:

The stock market is a giant distraction to the business of investing. -John Bogle

All the best,

David D. Moenning

Investment Strategist

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: IWM, AAPL – Note that positions may change at any time.

Trend Models Explained

Short-Term Trend Model: A series of indicator designed to identify the status of the stock market’s short-term (0-3 weeks) trend. The model compares the current price of S&P 500 relative to 5-day customized smoothing (weighted and moved forward 3 periods), the relationship of the 5-day to the 10-day, and the relationship of 10-day to 39-day.

Short- and Intermediate-Term Channel Breakout Systems: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, “The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen.”

Intermediate-Term Trend Model: A model designed to identify the status of the stock market’s intermediate-term (3 weeks to 6 months) price trend. The model compares the current weekly price of S&P 500 relative to relative to customized 10-week smoothing (weighted and moved forward 3 periods), the relationship of the 10-week to the 30-week, and the relationship of 30-week to 55-week.

Long-Term Trend Model: An indicator designed to identify the status of the stock market’s longer-term (>6 months) trend. The indicator compares the 50-day smoothing of the S&P 500 relative to its 200-day smoothing. When the 50-day is above 200-day, the indicator is positive and vice versa.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Short- and Intermediate-Term Trading Mode Models: These indicator attempt to identify whether the current market action represents a “trending” or “mean reverting” environment. The indicator utilizes the readings of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Momentum Models Explained

Short-Term Trend-and-Breadth Model: History shows the most reliable market moves tend to occur when the breadth indices are in tune with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates an All-Cap Dollar Weighted Equity Series and A/D Line. At the time of this writing, when the A/D line has been above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +26.5% per year since 1980. When one of the indicators is above its smoothing, the equity index has gained at a rate of +14.5% per year. And when both are below, the equity index has lost over -20% per year.

Intermediate-Term Breadth Model: A proprietary diffusion index developed by Ned Davis Research. The indicator is designed to determine the technical health of the market’s 157 sub-industry groups (GICS categorizes the market into 11 sectors, 20 industries, and 157 sub-industry groups). Technical health is determined by the direction of each sub-industry’s long-term smoothing and the rate of change of the sub-industry’s price index.

Short- and Long-Term Volume Relationship Models: These models review the relationship between “supply” and “demand” volume over the short- and intermediate-term time frames.

Intermediate-Term Price Thrust Model: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average.

Intermediate-Term Volume Thrust Model: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume to the 10-day total of daily declining volume. The indicator supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions.

Breadth Thrust Model: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. Historically, the NASDAQ Composite has performed much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust.

NOT INVESTMENT ADVICE. The opinions and forecasts expressed herein are those of Mr. David Moenning and Redwood Wealth and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as investment recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning and Redwood Wealth may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.